Publicly traded trailer and truck body manufacturer Wabash's financial performance “exceeded expectations” in the third quarter, primarily due to strong material margin, favorable product mix, and strong results from parts and services, tanks, and truck bodies, the company reported Oct. 25.

Q3 net sales reached $632.8 million, a 3.4% decrease compared to the same quarter of the previous year. Wabash also reported consolidated gross profit of $123 million, equivalent to 19.4% of sales. Operating income amounted to $77.6 million, or 12.3% of sales for the quarter.

"At Wabash, we believe in the power of strong connections," said Brent Yeagy, president and chief executive officer. "We've successfully created value by redefining our relationships with customers and suppliers, and now, we're ready to take it to the next level. With digital transformation as our compass, we are poised to extend our reach even further within the dynamic segments of transportation, logistics, and distribution as we set the groundwork to deliver an innovative digital marketplace that will endeavor to enhance efficiency for our customers by pulling on the full breadth of our partner ecosystem."

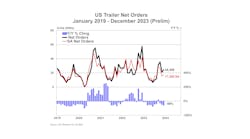

As of September 30, total company backlog stood at approximately $1.9 billion, a decrease of 20% compared to the third quarter of 2022. Wabash attributed the reduction to the timing of order activity, which is likely to come toward “the later end of typical seasonal patterns” for the industry. Backlog expected to be shipped within the following 12-months amounted to approximately $1.4 billion.

"We are raising the bar considerably for the peak earnings potential of Wabash,” Yeagy said. “We are also poised to generate significant free cash flow in 2023 even while making meaningful investments in our operations. As we navigate softer near-term demand conditions within the dry van market, we expect the strength of our first-to-final-mile portfolio to be apparent as truck bodies, tank trailers and parts and services support our results leading to what we anticipate will be our best-ever trough performance in 2024."

Segment highlights

During the third quarter, Transportation Solutions achieved net sales of $582.9 million, a decrease of 4.7% compared to the same quarter of the previous year. Operating income for the quarter amounted to $89.4 million, representing 15.3% of sales.

For Q3, Wabash shipped 10,765 trailers, compared to 13,365 trailers for the period last year (a 19.5% decrease). Truck body shipments for the quarter were 4,160, up from 4,115 (a 1.1% increase).

Parts & Services' net sales for the third quarter reached $56.4 million, an increase of 20.8% compared to the prior year quarter as the segment continued to make “notable strides” along its path of strategic growth. Operating income for the quarter amounted to $12.4 million, or 21.9% of sales.

See the November print edition of TBB for coverage of the Wabash quarterly earnings call with investment analysts.