THE market for commercial trucks and trailers is good—and it is going to stay that way for the next few years, according to speakers at the recent ACT Research seminar in Columbus, Indiana.

The 50th such seminar that the company has conducted came at a time of solid industry sales performance, especially among trailer manufacturers. The seminar featured presentations by experts on the market for trailers, medium and heavy trucks, trailer fleet operation, and the domestic and global economies.

Regardless of the speaker and the topic, the message was generally the same—the commercial truck and trailer markets are in a prosperous period right now that should last for years to come.

For a day and a half, economists, industry suppliers, and analysts presented their views—past, present, and future, in their areas of specialization. Here are some of the highlights:

Trailers: Great and getting better

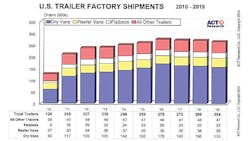

Factory shipments of truck trailers are expected to continue to climb all the way through 2016 and then taper off slightly, according to Frank Maly, ACT Research’s trailer industry analyst.

Maly estimates that manufacturers will ship 250,000 complete trailers this year, up 5% from the 239,000 trailers shipped in 2013.

Looking farther down the road, Maly believes the industry will ship 259,000 trailers in 2015 (up 4% from what trailer manufactures are expected to produce this year). He expects trailer shipments to reach 75,000 trailers in 2016 before softening slightly in 2017 and 2018. Despite the decline, trailer shipments are expected to remain at 264,000 in 2019, the last year in the ACT Research forecast.

Maly described the current market as strong, with solid quote activity. The demand is being supported by high freight volumes, with trailer fleets approaching capacity. And because of demand for their services, fleets are generating the money they need to buy trailers.

One advantage of today’s market is the gradual ramp-up that the industry has been experiencing since bottoming out in 2009.

Looking back at last year’s performance, total van shipments were up 4% from 2012. The volume of van shipments offset losses elsewhere in the industry. Platform trailers, for example, were off 9% from 2012. The dump trailer market was down 15%, and tanks finished 16% down from the previous year.

One strong point about 2013 was the low cancellation rate. If customers ordered the trailer in 2013, they almost always took delivery. Cancellations last year were only 3.9%, compared with a 5.7% cancellation rate in 2012.

Orders have remained strong through the 2013-2014 order season. Maly said brisk rates of requests for quotes are being converted into firm orders. Between October 2013 and February 2014, which Maly considers the current order season for truck trailers, manufacturers reported a 19% increase in orders compared with the corresponding period a year ago.

Orders from large fleets have been leading trailer manufacturers out of the recession, but now small- and medium-sized fleets are buying. In addition, trailer dealers are increasing their stock of new trailers.

Here are some of the factors on which the forecast is based:

• The growth in freight volumes combined with slowing improvements in the ability of trailer customers to improve their productivity. In recent years, fleets have been able to make significant productivity gains and haul more freight with existing equipment. As the productivity gains slow down and freight demand continues to grow, fleets are more inclined to buy new equipment.

“The pace of freight growth has been solid, and it lays a strong foundation for trailer sales over the next few years,” Maly said.

• Old equipment. The average age of trailers on US highways remains higher than the historical average. The severity of the 2009 downturn, combined with a long cautionary period on the part of trailer customers, has resulted in plenty of old trailers still being used. This old equipment affects fleet productivity and ability to serve shippers. The ACT Research forecast calls for strong trailer sales through 2019, leading to a reduction in the average age of trailers all the way to the end of this decade.

• Tractor/trailer balance. The traditional ratio between tractors and trailers has been out of balance recently as fleets spent more money on tractors. The ratio was especially high in 2010, but it has gradually returned to normal range.

• A growing, younger fleet. From 2007 to 2011, the number of trailers operating in the United States declined by 9%. The number of dry-freight vans shrank by 12%. The trend began to reverse in 2012, the first increase in fleet size since 2007.

ACT Research believes the overall trailer fleet will grow by approximately a million trailers by 2019. The company expects approximately 3.8 million trailers to be operating in the United States by the end of the decade. Approximately 2.8 million trailers were on the road in 2010.

Fleet productivity is somewhat mixed, Maly pointed out. On one hand, fleets have reaped the benefits of new technologies such as routing and tracking software that have made it possible to travel fewer miles deliver the same amount of freight. However, hours of service and other regulations have placed downward pressures on fleet productivity, leading to more trailers being needed to move the same amount of freight.

Maly does not foresee intermodal having a major impact on trailers. Even though domestic container volume doubled in 10 years, it still represents a small part of total freight movement. In addition, TOFC was the only category down year-over-year in 2013.

One potential boon for trailer shipments is the possible legalization of 33-ft doubles trailers. If approved, they would represent an 18% increase in capacity when compared to the 28-ft doubles trailers being used today. This would render obsolete the estimated 325,000 pup trailers currently on the road.

The authorization of 33-ft doubles trailers could be written into the transportation bill that would replace the current highway bill that will expire in September.

Medium trucks: smooth ride ahead

If the medium-duty truck forecast is accurate, the folks who install truck bodies and equipment can expect steady growth for the rest of the decade.

ACT Research’s Steve Tam provided details of what his company expects to see—a continuation of the smooth, manageable growth that began in 2010.

Last year, retail sales of these medium-duty trucks totaled 202,000, up from 188,000 in 2012. Of those, 155,000 were trucks, 33,000 were bus chassis, and the rest (14,000) were recreational vehicles. Each of these segments are expected to post moderate growth this year—9% each for trucks and buses, and 14% for RVs.

“You will see a little bit of upward pressure on build rates this year, but nothing to write home about,” Tam said. “The market has been showing a very gradual, very sustained growth rate.”

Historically, approximately 70% of the Class 5-7 trucks built in the United States is used as trucks or step vans. Buses take 18% of the market, with recreational vehicles absorbing the remaining 11%.

Tam broke down the truck market into five segments. Over the past 10 years, approximately 74% of Class 5-7 trucks have gone into distribution applications. Construction trucks make up 15% of the truck market. Four percent are used as refuse vehicles, and another 4% are used in service. Fire and emergency vehicles consume the remaining 3% of production, Tam said. The percentages have remained relatively unchanged during the past decade.

“The medium-duty market is amazingly diverse,” Tam said. “Heavy-duty trucks have an almost homogenous job—to haul freight. Yes, the freight varies, but generally the work of a heavy-duty truck is to haul freight. The picture for medium-duty trucks is totally different. We have identified more than 220 different applications for medium-duty trucks. Because of that diversity, you don’t have quite the jigs and jags of the heavy truck market. If you graph medium trucks over time, it’s more like a series of rolling hills and valleys.”

Changes in demand for medium trucks come primarily from consumer spending, Tam said, and housing-related products have an especially significant effect far beyond the actual construction of the house. And the current housing market bodes well for future sales of medium-duty trucks.

“We have the lowest level of existing homes on the market than we have seen in years,” Tam said.

Medium-duty trucks are operated between five and are driven between 20,000 and 60,000 miles per year. As a rule of thumb, customers pay approximately $10,000 per GVW class, not including the body.

In the medium truck market, the trend is toward lighter vehicles, Tam said. Among Classes 5-7, Class 5 trucks were almost nonexistent in 1998, while almost all trucks in this range were either a Class 6 or Class 7. Today, Class 5 models represent almost half of the market.

“We think that the market has reached equilibrium,” Tam said. “In the future, we may see a 60-40 spit one way or the other, but Class 5 models are here to stay.”

It has been a time of transition for individual truck manufacturers in the aftermath of the 2009 recession. Ford had less than 20% of the medium-duty truck market at the bottom of the recession. Since then, the company’s market share has risen to 30%. Freightliner also has been getting and increased share of the market, from just under 20% in 2012 to almost 25% last year. Much of this has come at the expense of International. Approximately one out of three Class 5-7 trucks sold in 2009 were built by International. By last year, the ratio had fallen to just over 20%.

Among the statistics Tam mentioned regarding the bus market:

• Buses represent the second largest market for medium-duty chassis.

• Three types of buses are the Type C school bus, which is 85% of the bus market.

• Shuttle and commercial buses are 2%.

• Urban and other types represent 13% of the market.

The key factors that drive the demand for buses include demographics, tax receipts, state and local government budgets, and fuel prices.

Heavy-duty trucks gain traction

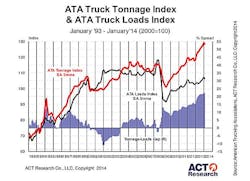

ACT’s Kenny Vieth had some good news for those involved with the Class 8 market: the economic factors that normally drive the sales of heavy trucks are expected to outperform customer productivity gains.

As long as fleet productivity gains outweighed freight growth, fleets could handle the increase with the equipment they had. But with freight increasing faster than fleets can increase productivity, they will need more trucks. That will translate into increased sales of Class 8 trucks in the next few years.

ACT Research believes fleets have picked most of the low-hanging productivity fruit, and that it will become increasingly difficult to become increasingly efficient.

“Our work suggests that 2012 was the high-water mark for the rate of productivity growth,” Vieth said. “Productivity is still growing above trend, but at a slower rate. If the economy grows as expected—even as productivity growth slows—the next several years will be very good for truckers and by extension new truck and trailer demand.”

Among Vieth’s reasons for optimism:

• The economy. GDP is expected to improve from 1.9% in 2013 to 2.8% in 2014, and 3.2% in 2015.

• A broader base of support. More market segments are growing stronger.

• Healthy consumer balance sheets

• Strong corporate profits

• Rising domestic energy production

• A rebound in domestic manufacturing

• Pent-up residential investment

• Continued low inflation

• An accommodative Fed policy

It’s not entirely rosy out there, though, Vieth warned. Domestic politics have the potential the slow things down, and the economy may experience a modest drag from slower growth in emerging markets. Issues particular to the Class 8 market include:

• The cost of a new Class 8 truck or tractor.

• Hours of service regulations in 2005 and 2013 are making fleets less efficient.

• Driver shortage becoming more acute

Other voices

Other observations from the speakers at the event:

From Jim Meil, vice-president and chief economist for Eaton:

• Freight grew steadily in 2013 and is off to a solid start to 2014.

• Financing conditions good, credit is available

• The transportation industry is lean

• The severe winter strained truck and rail delivery

• No slack capacity

From Sam Kahan, ACT Research economist:

• The outlook for the US economy is generally positive with upside surprises likely.

• The unemployment rate is slowly declining

• Inflation continues subdued

From Ken Vieth, ACT Research:

• U.S. Class 8 “active” population is about two million Units.

• Across applications, each truck is driven an average of 75,000 miles per year, for a total of 150 billion miles annually.

• Fleets average around six miles per gallon, consuming 25 billion gallons per year. In 2012, U S #2 diesel consumption was nearly 56 billion gallons.

• At today’s prices, compressed natural gas is $1.50 less than the equivalent energy content of diesel.

• Add all of these facts together, and compressed natural gas has the potential to save the trucking industry $37.5 billion per year in fuel costs. ♦