Trailer build numbers continue to be “surprisingly strong” despite declining orders, but FTR chairman/CEO Eric Starks believes builds will ease back over the next several quarters and be relatively flat seasonally through 2017.

“By the time we get to the first quarter of 2017, we feel in general that the industry will have right-sized its production relative to incoming order activity,” Starks said.

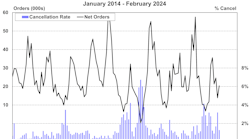

“Orders tend to be a leading indicator. We have found that orders are noticeably below build. What does that mean? If orders are below build for an extended time, build comes down. Both dry van and reefers are easing back. There is overbuilding within both of those, and we anticipate that build starts to depress.

“When we look at the flatbed market, it’s more equalized. While orders are still below build, they are much closer than we saw within the van market. So there is still a little downside pressure within this market, but I wouldn’t call it significant. Tanks have been decimated. That thing took a dive. It finally is to the point where build is more in line with incoming order rates. So we wouldn’t anticipate significant change within the build environment there.”

In his presentation, “Economy, Freight, and Trailer Demand: What To Expect In 2017 and Beyond,” Starks said trailer production was 71,000 in the first quarter of this year and 74,000 in the second quarter. His forecast was for 68,000 in the third quarter and 60,000 in the fourth quarter, with 63,000 in each of the first two quarters of 2017, followed by 59,000 and 55,000 in the final two quarters.

Trailer backlogs have plunged from a peak of 186,000 at the end of 2015 to 110,000 in August.

“They’re still at relatively high levels, even though they have come down from peak levels,” he said. “We anticipate this number will start to ease back and flatten out over the next several months. Traditionally, if you’re in that sweet spot, it suggests you don’t necessarily need to increase builds or reduce builds. Directionally, it’s pointing downward. As we look forward, that number continues to move down, so there will be additional pressure over the next several months for there to be a reduction within the build environment.”

Trailer orders were very strong in 2015 at 302,000 units, and he characterizes 2016 as still a “healthy market” that he projects will be 276,000. The forecast for 2017 is 240,000.

“240,000 or 250,000 is about the right metric for the longer term growth going forward,” he said. “A 300,000 market is not realistic longer term structurally.”

He said he sometimes is chastised for providing forecasts, but not following them up later with the actual numbers. So how did his forecast of a year ago turn out? Well, quite nicely, thank you.

He predicted 71,000 trailers for the fourth quarter of 2015—just 1000 over the actual number—and nailed the first quarter of 2016 exactly at 71,000. And he was just 3000 off in the second quarter (71,000, compared to the actual number of 74,000).

“I don’t know if that’s dumb luck or what,” he said. “We’ve been telling everybody for a period of time to expect a slowdown. It’s been more of a gradual slowdown than some thought.”

Starks also addressed a number of economic topics affecting the trailer industry:

• Fuel. “Small and medium fleets have to buy fuel today. Then they can pass on the surcharge at a later date. But if we get to a point where timing is an issue and there’s a cash constraint, then some of them finally have to close their doors. We don’t want to see swift increases in the price of fuel. Ultimately, longer term structurally, it really doesn’t matter if the price is $4 or $2. What matters is stability. We are seeing stability. If it’s $4 and it’s stable, we can all operate in that environment. We have a new norm. It’s when there’s uncertainty in the market that problems are created. The fundamentals are less volatile than they were before. The US market has invested heavily in the crude environment.”

• US truck freight levels are easing back on growth. “Early on in the year, the ATA data was showing stronger growth than our FTR data. It came back down and was in line with FTR, then jumped back up. ATA data is actually saying things are a little bit better than what our data are suggesting. But in general, the trend continues to be slightly down.”

• Truck monthly freight loadings. “They are relatively flat. The theme is flat. If that was your norm, you’d be happy. But your norm is things are either flying up or taking a nosedive, and you can react to that. Flat is a different environment I don’t think any of us are really used to. So this creates an environment where we’re nervous. We think the worst. It’s hard to think positive thoughts when you’re nervous. So this flat environment is creating more uncertainty than normal.”

• Truck rates (without fuel) remain stagnant. “This is what carriers are charging the shippers. Rates have fallen and now they have stabilized. We have not seen rates picking up noticeably. This is important because this is how carriers make money. They need to see that rate going up. They would anticipate 3% to 4% average growth in base rates longer term structurally. This is part of why they are easing back on buying equipment.”

• ISM manufacturing index. “Manufacturing is the lifeblood of transportation. It’s 80% of all freight that gets moved. The index tells us by and large manufacturing is relatively flat. So it’s not shrinking, it’s not growing. We want to see that number as high as possible.”

• Chicago Fed National Activity Index. “They take 88 variables and shove them into one equation every month and come up with this metric. Trend growth is 1.5% to 2.5%. Historically, it’s been 3% to 3.5%. All this says is that we are growing at not an optimal level, but the level at which it can be sustained in the environment we’re in. Now, it’s 1.5% to 2.5%. If you get above that solid line, then you’re in an inflationary environment and the Fed has to hit the brakes. We’re not close. If we get above the bottom solid line, we’re in recession. The data is not telling us that either. There has to be some sort of imbalance—a shock to the system that pushes us into that. Right now, we’re seeing there is no distinct imbalance in the markets. While we are seeing a manufacturing environment that’s flat, we’re not seeing a market that is overheated or has an imbalance. An imbalance would have to come from abroad, and the global markets are probably the biggest uncertainty. OK, how insulated are we within the US market to the global markets? Well, we’re somewhat insulated. We’ve seen pricing on steel and on base commodities already changing. We’ve seen strengthening of the dollar, so it’s cheaper to import goods than export. It really comes down to the financial markets. Can they go into enough turmoil to pull us into recession? At the moment, everything we’re seeing is no. But that doesn’t mean it can’t impact our growth. We believe it could have half of one percent impact on growth. That doesn’t necessarily pull us into recession.”

• Payroll employment. “You don’t want to overpay them. You don’t want to underpay them. You want to get it right. Is growth within the payroll environment being maintained enough to support the economy? Right now, we are seeing that over the last four months, we’re sitting just under 200,000 average job growth per month. In an environment with 1.5% to 2% GDP and an unemployment rate near 5%, we are getting closer and closer to full employment. We are starting to see wages go up. A 200,000 job environment is about right to be sustainable. Longer term structurally, when we start looking at how many people are going to be available to be a worker and what jobs look like in the future, we’re talking only adding 150,000 jobs per month. That’s not a whole lot of jobs and that still keeps us at full employment structurally long term. What’s unclear is, does this number continue to go down and the economy starts to ease back?”

• Business. “In September 2014, business hit a peak on order activity. Since then, it’s been on a downward trend: ‘I do not need to add capacity.’ Over the last three months, it appears to have hit a bottom and things look like they are turning. It looks like a lot of the bleeding has stopped. Are businesses going to come back and start participating? I think if businesses continue to stay on the sideline for next year, structurally that becomes a problem for the overall economy.”

• Total business inventories. “They have a significant amount of inventory. Why would you order stuff when you already have the inventory? We have not seen these kinds of business inventory/sales ratio numbers since the Great Recession. This is probably the biggest barrier to growth when it comes to talking about business investment in the next six to 12 months. They have to reduce this inventory. When you’re cutting back on inventory, that’s negative GDP growth. So we would expect over the next several quarters, it will have a negative impact on GDP growth. In the short term, that suggests the economy will not be at its maximum output level. However, it is a correction. When we have a correction like that, we finally get to a point where we’re back to equilibrium. We need at least two more quarters, if not more, to get those inventories back in check.”