EVEN if 2015 doesn’t turn out to be a record year for trailer production, it will be a record year for reefers.

An estimated 45,600 will be built this year—well above the record of 39,450 set in 1999—according to Eric Starks, president of FTR.

“We’re seeing significant strength in what we call ‘Reefer Madness,’ ” Starks said. “Reefers are going crazy. Crazy! We’re seeing over 45,000 in production for this year. That’s crazy! We hadn’t even hit the 40,000 mark before. So this is a really good market. We’ve been talking to a lot of refrigerated carriers and shippers, and they continue to tell us the market is good and the fundamentals are there. So we don’t see a change in reefers in the short term.”

In his presentation, “Economy, Freight & Trailer Demand: What to Expect in 2016 & Beyond,” he said 2015 has been “phenomenal” for the trailer market.

“This thing has kind of crept up on us because it’s been such a good market for several years,” he said.

The trailer record came in 1999 at 307,800. This year is expected to settle in around 305,000.

“Some of the latest data suggest Q3 and Q4 could be higher than we projected—not substantially, more of a tweak,” he said. “There’s upside pressure, and given the order activity we’ve seen, there clearly is upside as we move into the early part of 2016. Where we really will notice a slowdown is the second quarter. It’s more of a nuanced slowdown, but it’s a slowdown nevertheless. Things will ease back from the high pressure point we’ve been seeing.

“All in all, 2016 will still be better than 2014 (265,000). This is more of a nuanced slowdown. So if you’re trying to come up with a silver lining, these numbers look really good over the next year and a half.”

As the market headed into 2015, Starks said the build rate was holding steady.

“We said, ‘This is the perfect spot for the industry—we hope they don’t increase build levels,’ ” he said. “And they increased build levels. And that’s OK. But it was such a stable market that everybody knew exactly how to operate within this. Now build has started to increase. Now there is an expectation that they’ll have to start coming back down to normal levels.

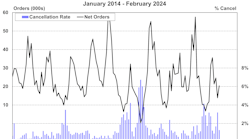

“Orders are a good indicator of where build is going to go in the future. Everything in general was on an upward trend—dry van and reefer. But flatbed is a concern. Holy moly. We’ve seen orders really, really weak in that market, so build continues to go down in the short term. With the tank market, we’ve seen some negative order months, and that’s problematic. We’ve already seen where tank production is on a downward trend. That will continue to be a struggle for the foreseeable future.”

He said that backlogs, while declining since the beginning of the year, are at healthy levels, with October’s totals up 31% year-over-year.

He said total trailer capacity utilization—the number of units that are active and moving freight in the system versus the total number of trailers in the market—is a great pressure gauge for understanding if more equipment needs to be purchased and put into service to meet freight demand. When it’s over 88%, it suggests an environment where fleets need to be expanded.

“Right now, we are above that number (at 90%) and that suggests we should see some fleet expansion in the market, and that’s what we’re seeing,” he said. “But in the next six or 12 months, we’ll start getting back to a level where things are more normalized.”

Economically derived demand (EDD) is replacement-demand expectations based on the freight market: Do you need to add or subtract equipment in the marketplace? Starks said EDD has been “all over the place. There is a bit of a lead/lag relationship. Some things that happened two years ago are impacting the sales environment today. They are relatively balanced now. We’re not seeing significant overbuy or underbuy. But as we get into 2016, we’ll see things starting to slow down a bit. There will be about a 10% falloff in demand.”

Starks said the new Phase 2 greenhouse gas (GHG) regulations, which include trucks and trailers in the equation, will start to take effect between 2018 and 2020, and fleets would expect to see significant improvements in fuel economy.

“One thing about it is that fleets ultimately should see better fuel economy as they continue to move forward,” he said. “From that standpoint, the payback is there. Even though the cost will go up—and it’s expected to be almost double, with what the latest GHG regulations look like—there should be enough of a payback where it’s easier to digest. It’s not like the engine regulations, where you had a loss of fuel economy.”

Some key segments from his analysis of the overall US economy:

• Business activity.

“Business activity is a big deal. Businesses are going to purchase your goods. We have to understand orders. You don’t build something unless you get an order. Capital goods orders continue to go down—seven months of negative growth. That’s not good. The last time we saw this was in 2012. Sometimes people go, ‘Oh, it’s the environment.’ No, it’s not always the environment. If things are moving in the economy, businesses buy. The question is, will we see something similar to what we saw in 2012? My guess is it will not be as pronounced.”

• Business inventories.

“You don’t like inventories because it’s cash sitting on the ground, not doing anything. I have to have inventory to meet the customer demand. We have found that businesses are trying to figure that out. Through the ‘90s, it came down and we hit bottom. This is a new dynamic. This is a big deal for transportation. Transportation was in an environment where they were expecting their customers to get leaner. As they got leaner, the pressure for transportation would go up. Things hit bottom in 2006 with 1.25 months of inventory. We are very lean. Shippers now are trying to figure out where their inventory level needs to be. For them, it was just leaner.

“Things are now holding steady. What concern I have is we’ve seen a jump the last several months in inventory up to 1.35 months of inventory. We don’t want to see that because it creates less pressure on the transportation system. Also, when that number goes up, that tells us shippers have too much inventory and the economy growth stops for a period of time. Is this a short-term issue or a long-term issue? We haven’t seen these levels since the Great Recession. We don’t want to see that much inventory sitting around.”

• Housing.

“It’s stagnant. That’s new construction and the existing home market. The new construction market has been stable. It was on a slow upward trend, but the last six months has flattened out. We see a significant opportunity as we look at the longer term structure. We’re seeing just below one million annual starts. We would expect we need to get closer to 1.5 million. There is some opportunity there. That’s 50% growth there. On the existing home market, it’s also starting to flatten out. But it’s way above the average we saw in the ‘90s. We want to see growth because it generates freight.”

• Automobiles.

“Robust. It’s in the 16.5 million, 17 million range—that’s a lot of cars. If people are going out and buying brand new cars, that typically tells me you’re feeling OK about things. It tells me people are still going to spend and lenders are willing to lend.”

• Freight levels.

“The freight market has been healthy, given that manufacturing has in essence stalled out. There was concern we’d see softness. Both indexes, the FTR and ATA, are telling us there is healthy growth in the market. Both were just under 5% in April. When one starts to diverge, it’s a problem, but we’re not seeing that.”

• Freight loadings.

“It’s going to look decent for the next couple of years in the number of loads. We saw the last peak in 2006, and we’re only now getting back to those levels. It’s taken us almost 10 years to get back to just where we were. For those of you who survived, kudos. Because it was painful. There are better days to come as we go forward.”

• Regulations.

“With so many on the way, we’re measuring the impact of all the regulations. We’re still only on the front end of the impact. When you look at this, you have big issues coming in 2017. What’s the possibility of some of these things being delayed? The numbers suggest they will need between 1.2 and 1.5 million drivers just to meet these regulations. And this does not go away. The trailer is the easy one to buy and put off to the side. It can be less utilized. You might see them buying more trailers in essence to keep that driver moving.” ♦