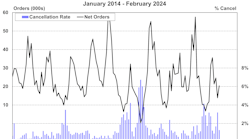

FTR’s Shippers Conditions Index (SCI) for April, as detailed in the June issue of the Shippers Update, fell from the previous month to a reading of -3.6.

The modest deterioration of this index, leaving it in a soft negative range in spite of tightening capacity utilization, reflects the ability of shippers to so far fend off any pricing increases from their contract carriers. Currently, FTR is forecasting the index to fall a little more through the year as capacity tightens further from an expected consumer bounce back after an anemic Q1. However, it is not expected to fall into double-digit negative range at any time during the forecasted period.

The SCI is a compilation of factors affecting the shippers transport environment. Any reading below zero indicates a less-than-ideal environment for shippers. Readings below -10 signal that conditions for shippers are approaching critical levels, based on available capacity and expected costs. The June issue of FTR’s Shippers Update, published June 10, details the factors affecting the April Shippers Conditions Index, along with discussion about current freight rates and why they are not rising in tandem with tight capacity utilization as can generally be anticipated.

Jonathan Starks, Chief Operating Officer at FTR, commented, “Strengthening economics are increasing the chance of capacity tightness late this year and into 2018. Despite the growing pressures from the market, the index has remained relatively stable, a testimony to the ability of contract trucking to sustain ever higher levels of capacity utilization without strong pricing pressure. The major takeaway here is the difference in prospect for contract and spot market players. Flexibility will be important, as changing market conditions in 2018 could easily invalidate budgets created in 2017. Notably, shippers will not be able to easily expand their baseload contract coverage to avoid spot market volatility.”