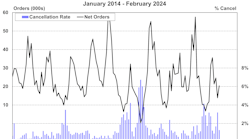

Confidence in the equipment finance market is 65.1, remaining at the highest index level in two years for the second consecutive month, according to the Equipment Leasing & Finance Foundation.

When asked about the outlook for the future, MCI survey respondent Thomas Jaschik, President, BB&T Equipment Finance, said, “The first quarter of 2014 had positive results with respect to new business activity, and the economy is on a positive trajectory. The conclusion of the winter of 2013-2014 may be the catalyst for pent-up demand to begin to be released. This will have a positive impact on the equipment finance market throughout 2014.”

April 2014 Survey Results:

The overall MCI-EFI is 65.1, unchanged from the March index.

• When asked to assess their business conditions over the next four months, 37% of executives responding said they believe business conditions will improve over the next four months, up from 31.4% in March. 60% of respondents believe business conditions will remain the same over the next four months, down from 65.7% in March. 2.9% believe business conditions will worsen, unchanged from the previous month.

• 37% of survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, up from 31.4% in March. 60% believe demand will “remain the same” during the same four-month time period, down from 62.9% the previous month. 2.9% believe demand will decline, down from 5.7% who believed so in March.

• 28.6% of executives expect more access to capital to fund equipment acquisitions over the next four months, a decrease from 31.4% in March. 71.4% of survey respondents indicate they expect the “same” access to capital to fund business, up from 68.6% in March. No one expects “less” access to capital, unchanged from the previous month.

• When asked, 37% of the executives reported they expect to hire more employees over the next four months, a decrease from 40% in March. 60% expect no change in headcount over the next four months, unchanged from last month. 2.9% expect fewer employees, up from no one who expected fewer employees in March.

• 2.9% of the leadership evaluates the current U.S. economy as “excellent,” down from 5.7% last month. 91.4% of the leadership evaluates the current U.S. economy as “fair,” up from 88.6% last month. 5.7% rate it as “poor,” unchanged from March.