Transport Canada (TC) and the Canada Border Services Agency (CBSA) have modified existing importation regulations in order to simplify and streamline the system for both foreign vehicle manufacturers and those Canadian commercial entities wishing to import those vehicles in for sale to the Canadian market. These changes took effect April 20.

Transport Canada is promoting the Beyond the Border Action Plan and the Single Window Initiative (SWI) in the streamlining process in order to convert to electronic formats which will ultimately lead to significantly reduced processing times and easier tracking.

This article will highlight the major changes as well as provide flow charts to follow for the different scenarios for importing foreign manufactured vehicles into Canada. Just as a reminder the Motor Vehicle Safety Act defines “manufacture” as, “in relation to a vehicle, includes any process of assembling or altering the vehicle prior to its sale to the first retail purchaser”.

Please note that these regulations and changes only apply to commercial entities that are importing fewer than 2500 vehicles per year into Canada and are insuring that they are importing the type of vehicles that the foreign manufacturer is registered for. For example, a foreign manufacturer that is identified on Transport Canada’s Appendix G for Semi-Trailer Air which is a trailer and is identified on a compliance label as TRA/REM (trailer) and attempts to ship a vocational truck that has had body or equipment added to it and is identified on the compliance label as TRU/CAM (truck) it will be refused entry into Canada.

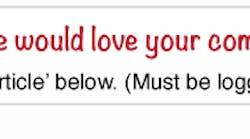

First, those manufacturers and importers that currently appear on TC’s Appendix G (Canadian companies authorized by Transport Canada to import new Canadian specification vehicles manufactured for the Canadian market) will not be affected provided that the importer meets the requirements of the CBSA.

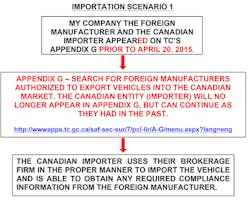

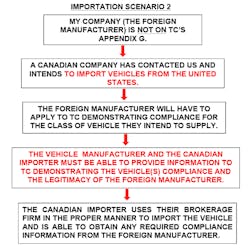

Second, foreign manufacturers that don’t currently appear on Appendix G will be able to apply directly to TC instead of filing an application through a Canadian entity that intends to become an importer for that manufacturer.

Third, Canadian entities intending to import vehicles via Appendix G Complete a Vehicle Import Form 1 for all imported vehicles as per the usual process. At a future date importers will be required to use the electronic Form 1 available for download from the Registrar of Imported Vehicles (RIV) website (https://www.riv.ca/).

Finally and most importantly, designated importers (DI) will no longer be recognized as a valid importer of record for foreign manufacturers unless they meet the requirements detailed in the following statement from TC. Here is why: In April 2014, the CBSA issued Customs Notice CN14-008, which reminded industry that a third party could not be shown as being the importer of record on Customs release documentation if the party could not meet the obligations and responsibilities of an importer in accordance with the Customs Act and its supporting regulations. An importer designated by a foreign manufacturer for the purpose of TC’s pre-clearance program is not considered the importer of record for CBSA release purposes; unless they are the true importer of record. As outlined in D17-1-4 paragraph 43 (4) (ii), the name of the importer of record must correspond with the name under which the company registered for its RM account. Furthermore, the importer at the time of interim accounting must be the party identified as the importer at the time of final accounting.

It is also essential that the importer or one of their employees act as the compliance contact for TC. This representative must be familiar with Canadian Motor Vehicle Safety Standards and how they relate to the Motor Vehicle Safety Act and the Motor Vehicle Safety Regulations. Recordkeeping for vehicle compliance will be maintained internally by both the importer and the foreign manufacturer and must be readily available in case of an onsite audit or if specifically requested. There is no charge to submit application to TC. Notices of non-compliance, vehicle detention, removal from the approved appendices, fines and/or imprisonment can result if you or your company does not comply with the MVSA or the MVSR.

We at the CTEA work diligently to insure that correspondence such as preclearance packages and preclearance applications between our members, TC and our association are concise, clear and organized. We offer review services to assist those companies wishing to apply in order to make it easy for the applicants and avoid any processing delays with TC.