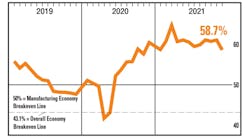

Economic activity in the manufacturing sector grew in December, with the overall economy achieving a 19th consecutive month of growth, say the nation’s supply executives in the latest Manufacturing ISM Report On Business.

The December Manufacturing PMI registered 58.7 percent, a decrease of 2.4 percentage points from the November reading of 61.1 percent. A reading above 50 percent indicates that the manufacturing economy is generally expanding; below 50 percent indicates that it is generally contracting. A Manufacturing PMI above 43.1 percent, over a period of time, generally indicates an expansion of the overall economy.

“The U.S. manufacturing sector remains in a demand-driven, supply chain-constrained environment, with indications of improvements in labor resources and supplier delivery performance,” Timothy R. Fiore, chair of the ISM manufacturing business survey committee, said. “Shortages of critical lowest-tier materials, high commodity prices and difficulties in transporting products continue to plague reliable consumption.

“Coronavirus pandemic-related global issues—worker absenteeism, short-term shutdowns due to parts shortages, employee turnover and overseas supply chain problems—continue to impact manufacturing.

However, panel sentiment remains strongly optimistic, with six positive growth comments for every cautious comment, down slightly from November, according to the survey.

What respondents are saying

- “Continued strong demand has our production facilities producing as many vehicles as we have materials for; however, capacity is limited due to the global chip shortage.” [Transportation Equipment]

- “Price increases appear to be slowing. Lead times are shrinking slowly, and inventories are growing. I hope we have reached the top of the hill to start down a gentle slope that lets us get back to something that resembles normal.” [Fabricated Metal Products]

- “Costs for steel seem to be coming down some. We have seen a little relief on steel prices, but they are still very high. Overall performance by suppliers has improved. On-time deliveries have improved.” [Machinery]

- “Supply chain interruptions have dramatically increased in the fourth quarter. Many of our suppliers are unable to deliver product until January or February 2022 or later.” [Miscellaneous Manufacturing]

- “Very robust order activity. Backlog increased. Plastic raw material shortages impact orders.” [Plastics & Rubber Products]

Broadly, demand expanded, with the (1) New Orders Index growing, supported by continued expansion of new export orders, (2) Customers’ Inventories Index remaining at a very low level and (3) Backlog of Orders Index staying at a very high level.

Consumption (measured by the Production and Employment indexes) grew during the period, with a combined negative 1.4-percentage point change to the Manufacturing PMI calculation. The Employment Index expanded for a fourth straight month, with some indications that ability to hire is improving, though somewhat offset by the continued challenges of turnover and backfilling.

Inputs—expressed as supplier deliveries, inventories, and imports—continued to constrain production expansion, but there are clear signs of improved delivery performance. The Supplier Deliveries Index again slowed while the Inventories Index expanded, both at a slower rate. In December, the Prices Index increased for the 19th consecutive month, at a slower rate (a decrease of 14.2 percentage points), indicating that supplier pricing power continues to rise, but to a lesser degree.

“Meeting demand will remain a challenge, due to hiring difficulties and a clear cycle of labor turnover at all tiers. For the second month in a row, Business Survey Committee panelists’ comments suggest month-over-month improvement on hiring, offset by backfilling required to address employee turnover,” said Fiore. “Supplier delivery rate improvement was indicated by the Supplier Deliveries Index softening in December. Transportation networks, a harbinger of future supplier delivery performance, are still performing erratically; however, there are signs of improvement.”