Trend moves to nearshoring, with companies taking outsourced production and moving it closer especially south of the border

ARE offshoring's days numbered? It appears so.

According to a recent AlixPartners survey of 80 C-level executives in 15 different industries, economic forces are driving how global manufacturing facilities are set up. Many are finding that nearshoring — taking production that was outsourced and transferring it closer to the United States for the US market — is outweighing the cheap cost of labor in Asian countries.

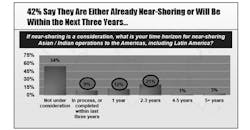

Forty-two percent said they are either already nearshoring or will be within the next three years: 9% said they are in the process or completed it within the past three years; 12% said they will do it within one year; 21% said two to three years; 1% said four to five years; and 3% said five-plus years.

Of that number, 63% said their first option is Mexico, with the US next at 19%, and Brazil third at 6%. Six percent said they were staying within the Asian/Indian region, but relocating to an even lower cost country.

“I expected to see a higher of response rate of Central America and perhaps Brazil, but Mexico was the dominant choice,” said Russ Dillion, director of AlixPartners. “That was an interesting development, considering the headlines you see about violence in Mexico. But when I went to Juarez, I found out that most violence is cartel versus cartel at night. It turns out the reality is there is a lot of business happening in Mexico — in all regions of Mexico.”

AlixPartners' annual Global Manufacturing Study compares the landed costs of components to the US marketplace, includes a Global Manufacturing Index that considers various cost factors (eg, wages, freight costs to US, currency), and looks at different parts individually and collectively as a market basket.

The 2011 Study indicated that: the US has regained some competitiveness relative to the Low Cost Countries (LCCs), largely due to a weaker dollar and LCC wage inflation; Mexico has the lowest landed costs; and other key/emerging LCCs (eg, India, Vietnam, Russia, Romania) remain more competitive than China, but have higher costs than Mexico.

All major LCCs improved their cost advantage versus the US during 2009 due to the recession, but the US regained some cost advantage (due largely to a weak dollar) over the past two years. Most currencies (eastern Europe, China, India, Mexico) saw gains against the weak US dollar. Vietnam's currency weakened again in 2011 by 5% against the dollar.

A combination of assumptions for China would increase the landed cost of the China part to that of the US-manufactured part. Annual increases are expected in China's wage rate (30%), exchange rate (5%), and freight rate (5%), so that by 2015, the landed cost of a China part will equal the cost of a US-manufactured part for the market basket of parts analyzed.

Dillion says the LCCs' competitiveness relative to US manufacturers will erode, as key general manufacturing cost drivers (logistics, materials, etc) stabilize at more economically sustainable levels.

“Asian LCCs will be more impacted than Mexico,” he said. “China, in particular, will experience negative pressure on landed cost, due to wage inflation — labor unrest, greater unionization, double-digit inflation — and exchange-rate pressures such as international pressure to float the yuan. There also will be higher freight rates due to increasing demand for oil.”

Analyzing the Strategies

What does this mean for companies' supply-chain strategies?

He listed these basic considerations:

-

What is the end market?

-

What is the appropriate risk-reward profile? “If you're a healthy company and looking to go from good to outstanding profit, this may be too risky a move. On the other hand, if you're a company that's having some issues and losing some cash, this can be a way to not only reduce costs but pull cash out of the supply chain.”

-

What is the demand fluctuation profile?

“There is an increased cash focus,” he said. “We are seeing more involvement by private equity sponsors. There is a lot of growing influence of private equity sponsorship, and when that happens, they do have bank covenants that have tighter cash restrictions and therefore cash is more important — probably disproportionately compared to income-statement line items. If the decision is to outsource and extend the supply chain, you will face a lot more opposition when private equity is involved.

“Companies need to understand the rapid changes in global cost-competitiveness. The correct strategy is product-dependent. The necessary analysis takes more time, effort, and expertise than it has in the past. Analyses need to be done more frequently to remain relevant. Simple rules and conclusions are usually not optimal.”

According to the survey: 87% of respondents own or operate operations outside the US, and 83% have third-party operations relationships outside the US; and 42% of respondents are either already nearshoring or likely to nearshore in the next three years.

Respondents also answered questions related to plans for offshoring current US operations: 27% of respondents expect to offshore US operations within the next three years, with Mexico also being their top choice for offshoring locale; just 21% have experienced supply-chain disruption due to security issues in Mexico; and 50% expect security/safety issues in Mexico to improve in the next five years.

Forty-two percent said they are either already nearshoring or will be within the next three years. The breakdown: 9% said they're in the process or completed it within the last three years; 12% said one year; 21% said two to three years; 1% said four to five; and 3% said five-plus years.

The most attractive advantages expected from nearshoring: lower freight costs, 30%; improved speed to market, 25%; lower inventory (in-transit) costs, 18%; time-zone advantages (easier management, coordination), 16%; and improved cultural alignment with North American managers, 11%.

“Rising fuel prices and a renewed focus on working capital has increased the attractiveness of nearshoring,” he said.

Thirty-seven percent are in the process or have completed offshoring within the last three years; 27% expect to offshore within three years; 28% said it's not under consideration.

Of that number, 43% said their first option is Mexico, followed by China (30%), India (14%), eastern Europe (5%), Canada (3%), Brazil (3%), and other (3%).

“The numbers themselves are a little counterintuitive in terms of Mexico, but it will be interesting to see how this changes over time, considering the direct result of two factors: the violence in Mexico and cost competitiveness of the low-cost countries relative to the US.”

Very little supply-chain disruption

Primary concerns associated with offshoring: safety/security, 38%; extension of supply chain, 17%; performance deterioration, 13%; political stability, 12%; loss of direct control, 10%; language/cultural barriers, 8%; customs/tariffs, 2%.

Only 19% said they had experienced any supply-chain disruption due to security issues in Mexico.

“I was surprised to see that, because even if you don't have manufacturing assets in Mexico, you're likely to have a supplier in Mexico, and I have heard of a supplier's truck that was taken or held hostage and got delayed for a week,” he said. “But one of my customers ran two full truckloads of pretty high-value content — copper — from Nicaragua to northern Mexico every day, and generally speaking, he had no problems.”

Fifty percent said they expect security/safety issues in Mexico to improve in the next five years. The breakdown: 5% expect dramatic improvement; 45% modest improvement; 29% unchanged; 14% worsen over time; and 7% said the situation is spiraling out of control.

From AlixPartners' observations, most US companies did not make big supply-chain changes during or immediately after the global recession.

“There was a high level of uncertainty, and it was not clear when the economy would hit bottom,” he said. “In many cases, the infrastructure — plants, supply base, etc — needed to be rebuilt to bring work back from Asia to the US or Mexico. China is now the second-largest economy in the world, and still very attractive as a target for long-term growth.”

He said manufacturing in China may not be the best solution for certain products because of continued wage and freight cost pressure. Mexico had the most attractive landed cost (to the US) for AlixPartners' market basket of parts.

“We are seeing an uptick in nearshoring activity, with a strong bias towards Mexico,” he said.

About the Author

Rick Weber

Associate Editor

Rick Weber has been an associate editor for Trailer/Body Builders since February 2000. A national award-winning sportswriter, he covered the Miami Dolphins for the Fort Myers News-Press following service with publications in California and Australia. He is a graduate of Penn State University.